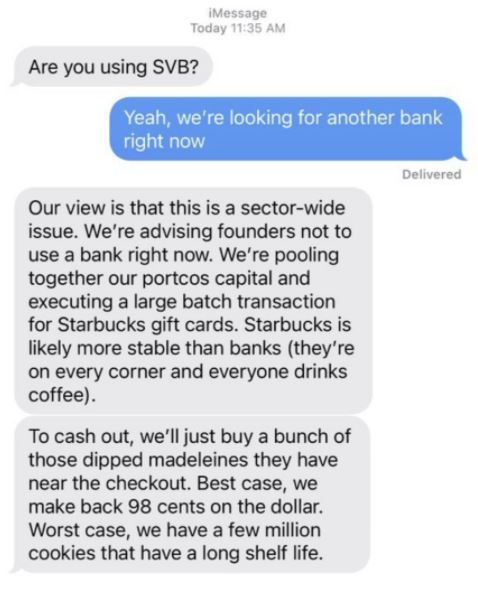

I have no idea if this is a real conversation or not, but the point being made about the collapse of Silicon Valley Bank is interesting.

So is Starbucks more stable than the banking system?

I think one could easily make the argument that it is. The banks main asset are digits on computers and they engage in fractional reserve banking which is effectively a fraud and usury. Starbucks at least has tangible assets. They have coffee and various food products. Even though they are overpriced products, they are still at least real assets. There are also Starbucks all across America which represents a substantial amount of real estate.

All that said, Starbucks gift cards are probably a safer asset than dollars in a bank account right now. In fact, I’m not sure you can really argue otherwise.